2026 Commodities Outlook: When the “Supercycle” Fractures Into Many Cycles

While commodities as an asset class may be under-owned in large institutional portfolios, that underweight is not enough to automatically extrapolate large outperformance. Market players will need to be rewarded for increasing their weights. Of course, it can happen; just look at how after over a decade of frustration, gold and silver bulls have started to be rewarded these past few years. Each commodity has unique drivers and factors weighing on their respective reward/risk setups.

Divergence, Not Uniformity

A defining feature in 2026 is structural divergence: price behavior is increasingly driven by each commodity’s specific exposure to (1) physical scarcity, (2) monetary realignment and reserve behavior, and (3) technology-led demand shocks — especially those tied to AI infrastructure.

In practical terms, 2026 looks less like a single “commodities trade” and more like a set of distinct micro-markets. Monetary metals are responding to sovereign balance-sheet decisions; selected industrial metals and nuclear fuel are constrained by geology, permitting, and long lead times; energy is bifurcating between global oversupply dynamics and localized grid realities; and agriculture is splitting between biologically constrained protein markets and more elastic grain supply.

The macro context matters chiefly because it shapes what kind of commodity demand grows. Recent U.S. activity has been robust on the surface — 2025 Q3 real GDP reported at a 4.3% annualized pace, ahead of consensus — and consumption has been a major contributor. But the composition is important: service-led spending (healthcare and travel are notable categories) is less commodity-intensive than the heavy industrial surges of prior cycles, while “goods” demand has skewed toward high-tech equipment.

At the same time, the labor picture has lagged output, reinforcing a “productivity shock” narrative: job gains in the period referenced were unusually soft relative to headline growth. For commodities, this combination tends to reward exposures linked to targeted capex (data centers, grid upgrades, electrification hardware) rather than broad-based construction booms.

Monetary Metals: Gold as a Reserve Asset, Silver as a Supply Chain Problem

Gold in 2026 is increasingly framed not merely as an inflation hedge, but as a strategic reserve asset in a financial system perceived as more geopolitically “weaponized.” Gold has begun to decouple from its traditional driver set (particularly real rates), with price formation now dominated by the “re-monetization” thesis and central bank behavior.

Institutional expectations are becoming unusually explicit: surveys of institutional investors show many respondents anticipating significant gold appreciation in 2026, alongside rising targets among major banks. More important than the headline targets is the market structure implication: persistent sovereign buying can create a “floor” dynamic, where drawdowns are met with non-price-sensitive demand.

In the case of China, not only have they been large accumulators of physical gold, the Chinese government has disallowed exporting of gold and silver from the country. Other countries find themselves in similar situations -- not enough gold. South Africa, the United States, and other producing nations are finding that small mines are not getting the financing for growth, so the growth has to come from bigger mining companies. This means the net supply growth is slower than hoped. All of this added together creates a situation where gold prices can continue to rise -- as long as China continues to feel the need to support their currency and the countries that make up the “global south” group feel a need to further back their joint currencies with gold.

The bottom line is that certain governments have determined that they need to continue to accumulate more gold in order to appear to be more stable and economically viable for import/export transactions, and to correct problems with weak or closed banking systems. Attracting capital is vital for the prosperity of a nation, and being prudent with the country’s monetary reserves can go a long way to reducing macroeconomic disabilities perceived by business associates and investors. Other countries are accumulating gold for different reasons. Poland is a visible example where a rapidly expanding economy’s leadership is implementing a policy of diversification as its reserves grow.

Some of the accumulation data are hidden, some are shrouded in secrecy, and some are well publicized, but whether one accepts every estimate, the strategic conclusion is straightforward: gold demand is increasingly policy-and reserve-driven, not sentiment-driven.

Silver presents a different proposition. Here, the story is not primarily or merely monetary — it is also industrial and logistical. Silver is entering a fifth consecutive year of structural deficit, and the cumulative draw on inventories since 2021 is large relative to annual mine supply. Unlike gold, much of silver demand is consumptive: it is embedded in electronics and industrial processes, where recycling is frequently uneconomic at the margin.

The strategic takeaway is that silver may behave less like a “poor man’s gold” and more like a tight industrial input whose price can be forced higher by supply-chain stress — especially if demand from AI buildout continues to surprise.

If silver prices continue their current trajectory, it won’t be long before we will find out the level at which recycling IS economic; but that level could be quite a bit higher.

We believe great financial advice starts with truly understanding your goals, needs, and circumstances. Schedule a meeting with our Client Relations Director to discover if Guild Investment Management has a solution that will work for you.

Industrial Metals and Nuclear Fuel: Scarcity with Long Lead Times

For selected industrial inputs, a unifying theme is inelastic supply response. In markets where new capacity requires long permitting cycles, specialized equipment, and multi-year project timelines, price is often the only short-run rationing mechanism.

A “lost decade” of uranium underinvestment suggests that existing production coverage can look deceptively healthy while legacy mines deplete. The demand side is shaped by expanding reactor build plans and a longer-term expectation of higher capacity by 2040, including potential incremental demand from small modular reactor concepts. In this setup, the key variable becomes not the spot quote but the term-contracting cycle: utilities and governments, once convinced a shortfall is plausible, tend to secure supply years in advance — tightening the “available” market for everyone else.

Energy: One Market, Two Realities

Energy is a commodity area where divergence in 2026 is quite visible. Natural gas, for example, has many different markets around the globe. While natural gas is a byproduct of oil production and often gets lumped into the same investor “energy” allocation basket, its fundamentals and what drives its price complex are radically different from those of crude oil.

Global LNG (liquefied natural gas) markets may tilt toward oversupply as new export capacity ramps (two major terminals coming online in Texas and Louisiana, and another in Qatar). Gas supply is plentiful in the U.S., but domestic gas and power markets can tighten due to weather fluctuations, demand growth for new electricity generation for data centers, pipeline delays, and changing grid interconnection timelines. Therefore, gas pricing is regional and infrastructure-bound. A world that is “long LNG” can still contain pockets that are short deliverable power — especially when demand is 24/7, demanding high reliability, and geographically clustered. In that framework, the commodity is not simply gas; it is firm energy delivered at the right place, at the right time.

For crude oil, while the globe is currently well supplied with crude, there are a few places on the globe that have the ability to inspire large impulse moves in the price of oil. Any sudden shift in thinking about oil production changes in the Middle East, Russia, Iran, or Venezuela could cause price volatility in 2026. Looking longer-term, there is a potential swing factor on the horizon that many are not yet factoring into their calculus: technological progress in Chinese shale extraction could eventually reduce the marginal call on seaborne imports. If sustained, such a development can act as a structural headwind for oil prices by weakening a core source of incremental demand. The broader point is not that oil “cannot rally,” but that structural supply innovation in a major importing country can change the ceiling, even if geopolitical risk can still create episodic spikes.

Energy Investors Do Not Need Rising Molecule Prices to Find Profits

While the energy sector may not be the most exciting area of the market, representing only about 3% of the S&P 500 market cap, it does generate about 12% of S&P 500 free cash flow. After years of rationalizing balance sheets and becoming better stewards of investor capital, the sector up and down the stream (producers, pumpers, compressors, pipelines, refiners, and distributors) have the ability to generate handsome profits that can be distributed to shareholders.

Regardless of the particular fuel commodity you are talking about, the North American energy sector can offer good investment opportunities without a bull market in the commodity price.

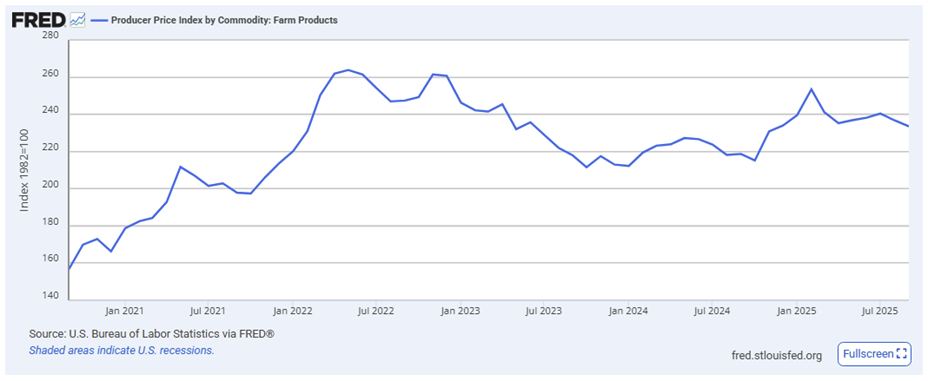

Agriculture: Protein Tightness Versus Grain Abundance

Agriculture, too, looks like a split market. Livestock supply is constrained by biology and herd dynamics, while grain markets are more responsive to positive weather trends and ongoing technological improvements in yield around the globe.

In protein markets, particularly livestock, once breeding stock is liquidated (as it has been over the last several years), the rebuild is slow — measured in years, not quarters — creating a structural floor under supply-driven tightness. In grains, absent a major weather or geopolitical shock, the supply response can be faster, and prices can behave more mean-reverting. There is a scenario where grains could be very strong in 2026 as relatively depressed agricultural commodity prices have asymmetric reward risk should there be weather issues in major growing regions.

Investment Implications for 2026

2026, we believe, will not be friendly to “one-size-fits-all” commodity exposure. Do not look for a “rising tide lifts all boats” trend. Instead, performance is likely to accrue to positions aligned with the specific scarcity mechanisms at work,… and not to mention getting the entry and exit timing right.

Gold as a policy- and reserve-driven asset whose bid is increasingly sovereign.

Silver as both a precious metal, and a potentially supply-constrained industrial input.

Uranium as a long-lead-time supply chain facing demand growth that is difficult to satisfy quickly.

Natural gas/power as a regional story, with divergent forces at work domestically and globally.

Agriculture as a split tape: protein tightness can persist while grains remain more weather- and supply-cycle dependent.

In 2026, the most investable opportunities may come from identifying where physical scarcity, infrastructure constraints, and sovereign behavior reduce sensitivity to the usual macro crosswinds — and where price must do the work of rationing demand.

Of course there is one large caveat to everything written about commodities: continued LIQUIDITY expansion is likely to be required for sustained bull runs in ANY asset class in 2026; commodities included. Next week, we will continue our 2026 preview series, with a deep dive into the liquidity dynamics that will have a lot to say about who is going to have an easier time making money in 2026, the bulls or the bears — and we’ll also touch on the universe of digital assets.

Thanks for listening; we welcome your calls and questions.

General Disclosures About This Newsletter

The publisher of this newsletter is Guild Investment Management, Inc. (GIM or Guild), an investment advisor registered with the Securities and Exchange Commission. GIM manages the accounts of high net worth individuals, trusts and estates, pension and profit sharing plans, and corporations, among other clients.

Your receipt of this newsletter does not create a personal investment advisory relationship with GIM although some recipients may also be advisory clients of GIM. GIM has written investment advisory agreements with all its personal advisory clients, which sets forth the nature of that relationship.

The newsletter makes general observations about markets and business and financial trends and may provide advice about specific companies and specific investments. It does not give personal investment advice tailored to the needs, objectives, and circumstances of individual readers. Whether investment ideas and recommendations are suitable for individual readers depends substantially on the personal and financial situation of that reader, which GIM, as the publisher of the newsletter, makes no effort to investigate.

GIM attempts to provide accurate content in its newsletters to the extent such content is factual rather than analysis and opinion, but GIM relies primarily on information compiled or reported by third parties and does not generally attempt to independently verify or investigate such information. Moreover, some content and some of the assumptions, formulas, algorithms and other data that affect the content may be inaccurate, outdated, or otherwise flawed. GIM does not guarantee or take responsibility for the accuracy of such information.

Please note that investing in stocks, other securities, and commodities is inherently risky, and you should rely on your personal financial advisors and conduct your own due diligence in connection with any investment decision.

A Special Comment for Guild’s Clients

If you are an investment advisory client of GIM who is receiving this newsletter, please note that the fact that a general recommendation is made of a particular security, commodity, or investment area to its newsletter subscribers does not mean that investment is suitable for you or should be purchased by you. For example, GIM may already have purchased such securities on your behalf or purchased securities in the same industry (and an increase in the position for you may represent too much concentration in one security or industry), or GIM may believe the investment is not suitable for you based on your risk tolerance or other factors. If you have questions about the recommendations in this newsletter in relation to your account at GIM, please contact Tony Danaher, Rudi von Abele, or Aubrey Ford.

Conflicts of Interest

As of the date of this newsletter, GIM’s investment advisory clients or GIM’s principals owned positions in areas that are the subject of current recommendations, commentary, analysis, opinions, or advice, contained in this newsletter.

GIM and its principals have certain conflicts of interest in its relations with its investment advisory clients and its newsletter subscribers resulting from GIM or its principals holding positions for its clients or themselves which are also recommended to its clients. GIM may change the positions of its clients or GIM’s principals may change their positions (increasing, decreasing, and eliminating them) based on GIM’s best judgment at any given time, including the time of publication of the newsletter. Factors that lead GIM to change or eliminate its positions may include general market developments, factors specific to the issuer, or the needs of GIM or its advisory clients. From time to time GIM’s investing goals on behalf of its investment advisory clients or the personal investing goals of GIM’s principals and their risk tolerance may be different from those discussed in the newsletter, and the investment decisions made by GIM for its advisory clients or the investment decisions of its principals may vary from (and may even be contrary to) the advice and recommendations in the newsletter.

In addition, GIM or its principals may reduce or eliminate their positions in an investment that is recommended in the newsletter prior to notifying the newsletter subscribers of such a reduction or elimination. The publication by GIM of a “target price” or “stop loss” for a particular security or other asset does not necessarily represent the price at which GIM intends to sell or will sell any such assets for its advisory clients or the price at which GIM’s principals intend to sell any such assets.

As a consequence of the conflict of interest, GIM’s clients or principals may benefit if newsletter subscribers purchase assets recommended by GIM since it could increase the value of the assets already held by GIM’s investment advisory clients or GIM’s principals. On the other hand, GIM’s principals and clients may suffer a detriment if they seek to acquire additional shares in securities that have been recommended and the price of the securities has increased as a result of purchases by newsletter subscribers.

To help mitigate these conflicts, GIM seeks to avoid recommending the securities of individual companies where GIM or its principals have an ownership position and where the issuer is small or its securities are thinly traded. That way sales by GIM in advance of possible sales by newsletter subscribers would not be likely to cause any significant decrease in the sale price to newsletter subscribers. GIM has a fiduciary relationship with its investment advisory clients and cannot agree on behalf of such clients to refrain from purchases or sales of a security mentioned in the newsletter for a period of time before or after recommendations for purchases or sales are made to its newsletter subscribers.

GIM encourages you to do independent research on the securities or other assets discussed or recommended in the newsletter prior to making any investment decisions and to be especially cautious of investments in small, thinly-traded companies, which are usually the most risky investments that you can make.

Disclaimer of Liability

GIM disclaims any liability for investment decisions based upon recommendations, information, or opinions in its newsletters. GIM is not soliciting you to execute any trade. Nothing contained in GIM’s newsletters is intended to be, nor shall it be construed as an offer to buy or sell securities or to give individual investment advice. The information in the newsletter is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject GIM to any registration requirement within such jurisdiction or country.

COPYRIGHT NOTICE

Guild’s current and past market commentaries are protected by U.S. and international copyright laws. All rights reserved. You must not copy, frame, modify, transmit, further distribute, or use the market commentaries, without the prior written consent of Guild. This email or any download from a secure website is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in error, any use, dissemination, distribution, or copying of this email is similarly prohibited. Please notify us immediately of the error by return email and please delete this message from your system. Although this email and any attachments are believed to be free of any virus or other defect that might affect any computer system into which it is received and opened it is the responsibility of the recipient to ensure that it is virus free and no responsibility is accepted by Guild Investment Management for any loss or damage arising in any way from its use.