Bitcoin’s Watershed Moment: A New Chapter in Digital Asset History

As Bitcoin reaches new all-time highs in 2024, we find ourselves at a pivotal moment in the evolution of digital assets. While many investment firms are only now beginning to acknowledge Bitcoin’s legitimacy and value as an investment asset, our clients have benefited from our early recognition of its potential. Since 2017, we’ve maintained that Bitcoin represents a new asset class, and have written about the technology extensively for our readers, as well as presenting at conferences; we’ve been investing in Bitcoin actively for our clients since 2019. On the day we first bought for some early adopters with high risk tolerance, the high price was $7,909. As we write, it hovers near $90,000 – a compound annual growth rate of over 56%.

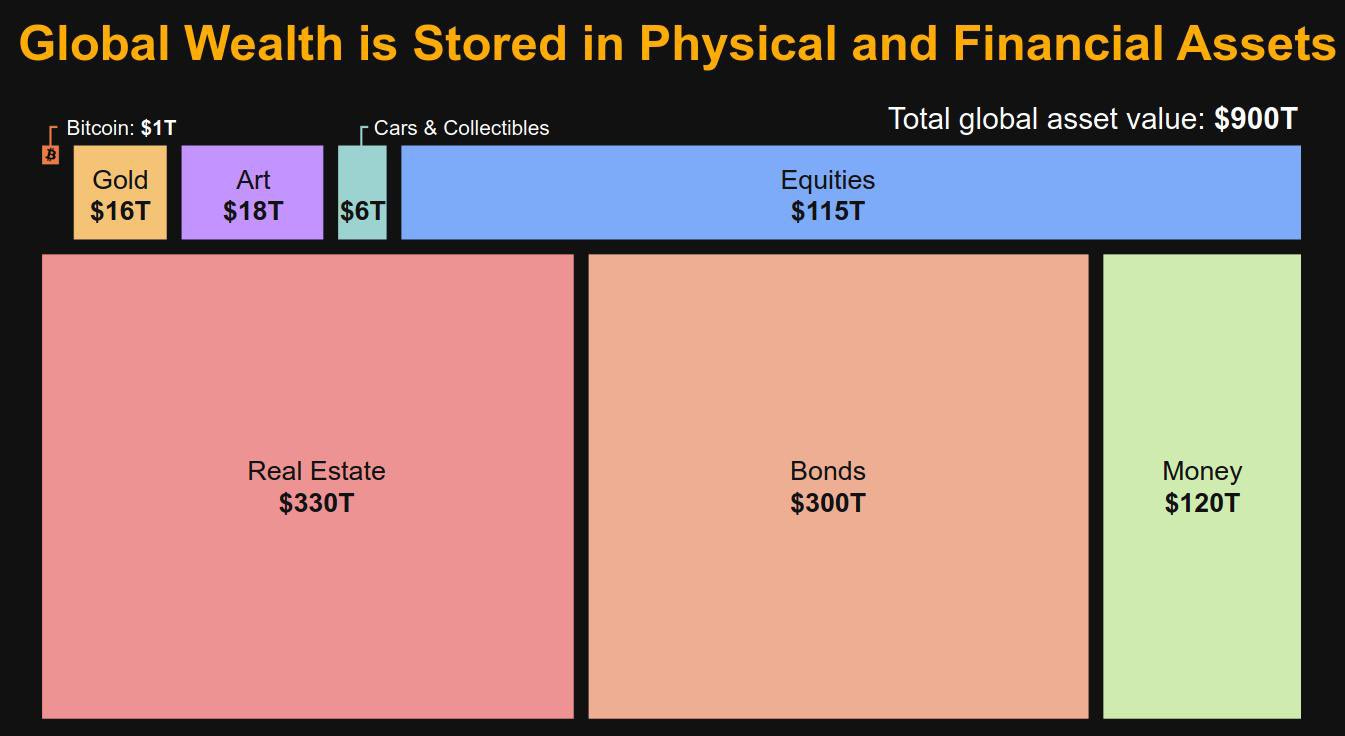

The above chart provides a powerful visualization of Bitcoin’s potential growth runway by comparing its current market value ($1.4 trillion in the chart, up to $1.8 trillion as we write) to other major asset classes. While Bitcoin has achieved remarkable growth in its relatively short existence, the chart illustrates that it still represents just a fraction of traditional stores of value and investment assets. For perspective, Bitcoin’s entire market capitalization remains smaller than gold ($16 trillion), significantly smaller than global equities ($115 trillion), and dwarfed by real estate ($330 trillion) and bonds ($300 trillion). Even if Bitcoin were to capture just a modest percentage of these massive asset classes as it gains broader acceptance as “digital capital,” the potential for value appreciation is substantial. This comparison becomes particularly relevant as Bitcoin transitions from a speculative digital asset to a legitimate component of institutional portfolios and potentially national reserves. It suggests that despite recent price advances, we may still be in the early stages of Bitcoin’s broader adoption curve as a significant global asset class. While any hard-and-fast Bitcoin valuation framework is still highly speculative, the image above frames the fundamental way we consider Bitcoin as the pole star of a new asset-class constellation.

The Shifting Regulatory Landscape

Keep reading with a 7-day free trial

Subscribe to Guild's Global Market Commentary to keep reading this post and get 7 days of free access to the full post archives.