Having written several times on AI this year, we thought we’d mention some more specific ways in which AI is likely to transform various sectors -- starting with healthcare. Below, we discuss two vectors of AI transformation in two different healthcare industries -- biopharma and managed care.

Biopharma Drug Discovery: Undoing the Curse of “Eroom’s Law”

“Eroom’s Law” for the biopharma industry is essentially the opposite of Moore’s Law in IT. While Moore’s Law observes that the number of transistors on a microchip doubles about every two years, leading to an exponential increase in computing power and a decrease in relative cost, Eroom’s Law observes a trend where the cost of developing a new drug doubles approximately every nine years. This observation indicates a historical decrease in drug discovery efficiency over time, despite advancements in technology and increased spending on research and development.

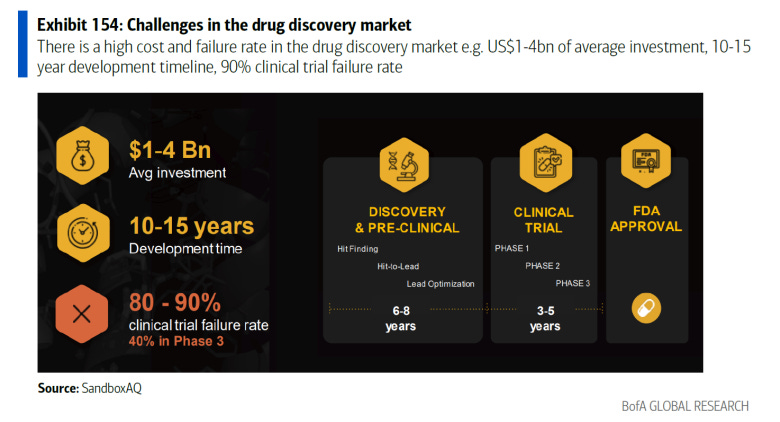

Eroom’s Law points to various challenges in the pharmaceutical industry, including increased regulatory requirements, higher standards for safety and efficacy, and the complexity of biological systems that make finding new drugs more difficult and costly. This trend has in the past raised concerns about the sustainability of drug development and the need for innovative approaches to improve productivity and efficiency in the industry. Indeed, it shapes the industry fundamentally, given the high failure rate of newly developed drugs and the economics of drug companies’ pipelines. Since the exclusivity of a drug is not permanent, even if it can be extended by various stratagems, the “pharma treadmill” means that companies must constantly be innovating and developing new therapies to stay alive. If over the course of time, drug development is becoming more and more expensive, that has the potential to become an albatross around the industry’s neck. Hence the excitement we’ve witnessed at various times about new drug discovery platforms.

The pharmaceutical industry now spends approximately $50 billion annually on research for new therapies, but despite this investment, the efficiency of discovering new drugs has diminished significantly. Thus, the prospect of generative AI suddenly arriving to foil this trend is of course tantalizing to drug developers.

A notable point is that while humans can typically process 6–7 data points simultaneously, AI can perform the iterative processes involved in drug discovery millions of times within minutes in a laboratory setting. This capability suggests a potential for AI to address some of the inefficiencies inherent in the drug development process. Potential applications of AI in this field include assisting in the selection of therapeutic targets, enabling personalized genomic screening for more accurate diagnoses and therapies, and optimizing clinical trials. However, the application of AI in drug discovery is challenged by the complexity and data density of biological systems, making it more difficult for AI models to process compared to more general applications, such as those seen with OpenAI’s ChatGPT.

One of the primary roles AI is expected to take over is the labor-intensive task of data mining in drug discovery, which includes collecting and profiling data from various sources for target identification and examining genetic associations for links between phenotypic evidence and genotypic markers. The challenge lies in homogenizing multi-modal data for AI processing, a task that is considerably more complex than preparing text or images for large language models (LLMs). Despite the hurdles, the potential for AI to revolutionize drug discovery remains significant… however, because there are unique intricacies to organic, biologic, and healthcare related data, AI models might not follow the same scaling principles as seen in other technology areas.

AI-Driven Simulations

Still, AI and related simulation technologies are making it possible to perform tasks in weeks or months that would have taken years in the physical domain. This highlights the potential for AI to streamline the lengthy and costly process of drug discovery, which often faces a high failure rate (about 90% of drugs that enter initial Phase One trials never make it to market), could make the industry’s business model more predictable and efficient. By simulating molecular structures and modelling their interactions billions of times, AI can help de-risk molecules, thereby reducing drug development timelines -- and increasing hit rates -- significantly.

“In silico” testing utilizes computer simulations to model and predict how new drugs will behave within the human body, and it may see a step-increase in efficacy with the integration of new AI tech. AI enhances in silico testing by employing advanced algorithms for predictive modeling, enabling the rapid and accurate prediction of a drug’s effects, including its potential efficacy and toxicity. This approach not only speeds up the drug discovery and development process by identifying promising candidates more efficiently but also reduces the reliance on costlier and time-consuming traditional methods, potentially decreasing the high failure rates of drug trials by allowing researchers to focus on the most promising compounds from an earlier stage.

In short, Eroom’s Law might see a reversal with AI and simulation technologies, offering a path to more predictable revenues and efficient R&D processes. The evolution of technology in healthcare suggests a future where AI could play a pivotal role in achieving breakthroughs in treatments for various conditions, transforming drug discovery’s efficiency and innovation.

Managed Care and Medicare… OOPS!

After a disappointing 2025 Medicare Advantage rates announcement put margin pressure on payers, could AI come to the rescue?

Moving to a very different industry in the healthcare sector, managed care also has woes that AI might help resolve. The new Medicare Advantage (MA) rates announced for 2025 present several challenges to healthcare payers, affecting their operational, financial, and strategic frameworks. The finalized MA rates for 2025 showed a decrease of 0.16%, which was in line with proposals but fell significantly below investor expectations of a 0.9–1.0% improvement. This marks a departure from the previous trend where rates generally improved upon finalization -- particularly notable in an election year, suggesting a potentially tougher pricing environment ahead.

What is Medicare Advantage?

MA, also known as Medicare Part C, is an alternative to traditional Medicare (Parts A and B) that is offered by private insurance companies but approved and regulated by the Centers for Medicare & Medicaid Services (CMS). MA plans provide all the benefits of Parts A and B and often include additional benefits such as prescription drug coverage (Part D), dental, vision, and health and wellness programs. These plans operate on a fixed payment system from CMS per enrollee, which incentivizes the management of care and costs. The rates set by CMS for these plans are crucial for determining the financial viability and structure of the benefits they can offer.

Challenges Imposed by the New MA Rates

The contraction in MA rates challenges payers by squeezing margins, especially for those heavily reliant on MA plans for revenue and growth.

This outcome could delay the repricing cycle, adversely affecting payers’ ability to recover margins according to their planned timelines. The “repricing cycle” refers to the periodic process of adjusting the prices and benefits of insurance plans. This cycle is influenced by various factors, including changes in Medicare reimbursement rates set by CMS, healthcare cost trends, regulatory changes, and competitive dynamics in the marketplace.

When CMS announces new rates for MA plans, insurers must reassess their own pricing structures, benefit offerings, and cost management strategies to ensure their plans remain financially viable, competitive, and attractive to consumers. The repricing cycle involves analyzing these new rates, predicting their impact on margins and operational costs, and making necessary adjustments to plan premiums, benefits, and provider payment rates.

This cycle is crucial for maintaining the balance between offering value to members, ensuring adequate coverage and benefits, and sustaining the financial health and profitability of the insurer. Delays or disruptions in this cycle, such as those caused by rates falling significantly below expectations, can impact an insurer’s ability to recover margins and adapt to the evolving healthcare and regulatory environment.

The need for strategic decisions becomes more pressing under these constraints. Lower rates may force payers to alter benefit designs, potentially reducing the attractiveness of their plans to consumers; financial pressures from rate adjustments may affect payers’ ability to invest in new technologies, markets, or care models. Rates influence decisions on administrative costs, provider networks, and patient care strategies to maintain financial health.

AI to the Rescue?

The tightened pricing environment demands more efficient operation and margin management from healthcare payers. AI can play a crucial role in identifying inefficiencies, predicting areas of risk, and optimizing pricing strategies to maintain competitiveness.

With CMS’s emphasis on coding accuracy and its impact on reimbursement, AI technologies can enhance coding processes, ensuring that patient acuities are accurately captured and communicated, thus potentially improving revenue flows. AI can streamline operational processes, automate routine tasks, and analyze data to identify cost-saving opportunities, hopefully without compromising patient care quality. This is particularly relevant in the context of administrative cuts and medical management initiatives.

For companies exposed to MA and engaging in value-based care (“VBC” -- an increasingly prevalent healthcare delivery model in which providers, including hospitals and physicians, are paid based on patient health outcomes, rather than the volume of services they deliver), AI can refine patient management strategies, personalize care plans, and optimize provider networks, thus enhancing the ability to manage core medical costs more effectively than supplemental benefits. AI’s predictive analytics can also aid healthcare payers in better forecasting future trends, preparing for rate changes, and adjusting strategies proactively rather than reactively.

The healthcare payer industry, particularly those exposed to Medicare Advantage, faces a challenging environment characterized by disappointing rate adjustments and the need for strategic operational efficiencies. The application of AI across various facets of healthcare payer operations offers a promising avenue to navigate these challenges, and we expect to see further uptake of AI tools in this industry -- and anticipate that those companies deploying AI most effectively will outperform. As the industry continues to evolve, as the population ages, and as the social management of healthcare expenditures becomes more pressing, leveraging AI technologies could become increasingly central to maintaining competitive margins in the managed-care industry.

On the Opposite Side of Everything Digital, New, and Intangible, Let’s Talk About Gold’s Momentum

After a long period of quiescence (especially versus other investment and speculative assets like stocks or bitcoin), gold is finally demonstrating some price momentum. There is some varied debate about what has spurred this last move, but many believe it to be powered by the increasingly apparent persistence of inflation above the Fed’s long-term target… while the FOMC telegraphs interest rate cuts. Or perhaps the increasing suspicion is that long-term inflation targets may be being quietly (or publicly) raised.

As watchers of gold for many years, we are pleased to see gold making progress; in some ways it’s a reminder that there remains some monetary conservatism somewhere in the world.

Let’s consider the other possible reasons behind the yellow metal’s latest move:

Bitcoin’s rapid ascent has cooled. We continue to believe that bitcoin has greater long-term potential, due particularly to its decentralized, digital character and the ease with which it can serve as a store of value to citizens of global jurisdictions that lack the rule of law, but there remains plenty of utility for gold as a “hard to trace” store of wealth.

While Russia could be a likely seller of gold, the woes of the Chinese stock market and real estate markets may be leading to increased demand for gold by Chinese investors and speculators.

As we wrote last month, with global liquidity being stimulated since late 2022, and global debt markets of over $313 trillion (and climbing), it is not surprising that perceived hard asset prices should also rise along with other assets.

The cost structure in the gold mining industry is rising rapidly… much faster than the price of the metal. Miners around the world are having trouble producing gold profitably… meanwhile central banks have been accumulating all that the miners have been producing.

There has been an increased demand to take delivery, and we have seen widening dislocations between the price of paper gold (futures and other derivative instruments) and the price of physical gold.

Lastly, to put it succinctly… It broke out. Gold is now at all-time highs versus every currency; in U.S. dollar terms, it has risen 25% in six months from its October 2023 lows (which were hit on October 6, as it happens; some things changed after that date). Sometimes momentum begets momentum.

Thanks for listening; we welcome your calls and questions.

General Disclosures About This Newsletter

The publisher of this newsletter is Guild Investment Management, Inc. (GIM or Guild), an investment advisor registered with the Securities and Exchange Commission. GIM manages the accounts of high net worth individuals, trusts and estates, pension and profit sharing plans, and corporations, among other clients.

Your receipt of this newsletter does not create a personal investment advisory relationship with GIM although some recipients may also be advisory clients of GIM. GIM has written investment advisory agreements with all its personal advisory clients, which sets forth the nature of that relationship.

The newsletter makes general observations about markets and business and financial trends and may provide advice about specific companies and specific investments. It does not give personal investment advice tailored to the needs, objectives, and circumstances of individual readers. Whether investment ideas and recommendations are suitable for individual readers depends substantially on the personal and financial situation of that reader, which GIM, as the publisher of the newsletter, makes no effort to investigate.

GIM attempts to provide accurate content in its newsletters to the extent such content is factual rather than analysis and opinion, but GIM relies primarily on information compiled or reported by third parties and does not generally attempt to independently verify or investigate such information. Moreover, some content and some of the assumptions, formulas, algorithms and other data that affect the content may be inaccurate, outdated, or otherwise flawed. GIM does not guarantee or take responsibility for the accuracy of such information.

Please note that investing in stocks, other securities, and commodities is inherently risky, and you should rely on your personal financial advisors and conduct your own due diligence in connection with any investment decision.

A Special Comment for Guild’s Clients

If you are an investment advisory client of GIM who is receiving this newsletter, please note that the fact that a general recommendation is made of a particular security, commodity, or investment area to its newsletter subscribers does not mean that investment is suitable for you or should be purchased by you. For example, GIM may already have purchased such securities on your behalf or purchased securities in the same industry (and an increase in the position for you may represent too much concentration in one security or industry), or GIM may believe the investment is not suitable for you based on your risk tolerance or other factors. If you have questions about the recommendations in this newsletter in relation to your account at GIM, please contact Tony Danaher, Rudi von Abele, or Aubrey Ford.

Conflicts of Interest

As of the date of this newsletter, GIM’s investment advisory clients or GIM’s principals owned positions in areas that are the subject of current recommendations, commentary, analysis, opinions, or advice, contained in this newsletter.

GIM and its principals have certain conflicts of interest in its relations with its investment advisory clients and its newsletter subscribers resulting from GIM or its principals holding positions for its clients or themselves which are also recommended to its clients. GIM may change the positions of its clients or GIM’s principals may change their positions (increasing, decreasing, and eliminating them) based on GIM’s best judgment at any given time, including the time of publication of the newsletter. Factors that lead GIM to change or eliminate its positions may include general market developments, factors specific to the issuer, or the needs of GIM or its advisory clients. From time to time GIM’s investing goals on behalf of its investment advisory clients or the personal investing goals of GIM’s principals and their risk tolerance may be different from those discussed in the newsletter, and the investment decisions made by GIM for its advisory clients or the investment decisions of its principals may vary from (and may even be contrary to) the advice and recommendations in the newsletter.

In addition, GIM or its principals may reduce or eliminate their positions in an investment that is recommended in the newsletter prior to notifying the newsletter subscribers of such a reduction or elimination. The publication by GIM of a “target price” or “stop loss” for a particular security or other asset does not necessarily represent the price at which GIM intends to sell or will sell any such assets for its advisory clients or the price at which GIM’s principals intend to sell any such assets.

As a consequence of the conflict of interest, GIM’s clients or principals may benefit if newsletter subscribers purchase assets recommended by GIM since it could increase the value of the assets already held by GIM’s investment advisory clients or GIM’s principals. On the other hand, GIM’s principals and clients may suffer a detriment if they seek to acquire additional shares in securities that have been recommended and the price of the securities has increased as a result of purchases by newsletter subscribers.

To help mitigate these conflicts, GIM seeks to avoid recommending the securities of individual companies where GIM or its principals have an ownership position and where the issuer is small or its securities are thinly traded. That way sales by GIM in advance of possible sales by newsletter subscribers would not be likely to cause any significant decrease in the sale price to newsletter subscribers. GIM has a fiduciary relationship with its investment advisory clients and cannot agree on behalf of such clients to refrain from purchases or sales of a security mentioned in the newsletter for a period of time before or after recommendations for purchases or sales are made to its newsletter subscribers.

GIM encourages you to do independent research on the securities or other assets discussed or recommended in the newsletter prior to making any investment decisions and to be especially cautious of investments in small, thinly-traded companies, which are usually the most risky investments that you can make.

Disclaimer of Liability

GIM disclaims any liability for investment decisions based upon recommendations, information, or opinions in its newsletters. GIM is not soliciting you to execute any trade. Nothing contained in GIM’s newsletters is intended to be, nor shall it be construed as an offer to buy or sell securities or to give individual investment advice. The information in the newsletter is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject GIM to any registration requirement within such jurisdiction or country.

COPYRIGHT NOTICE

Guild’s current and past market commentaries are protected by U.S. and International copyright laws. All rights reserved. You must not copy, frame, modify, transmit, further distribute, or use the market commentaries, without the prior written consent of Guild. This email or any download from a secure website is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in error, any use, dissemination, distribution, or copying of this email is similarly prohibited. Please notify us immediately of the error by return email and please delete this message from your system. Although this email and any attachments are believed to be free of any virus or other defect that might affect any computer system into which it is received and opened it is the responsibility of the recipient to ensure that it is virus free and no responsibility is accepted by Guild Investment Management for any loss or damage arising in any way from its use.