Multivariable Calculus

Last week, we used some of our own arithmetic to explain the correction that tech stocks were experiencing and the fierce rotation into other sectors. That was looking at what was happening. When we look forward at these next few months, we believe it requires graduating from arithmetic to multivariable calculus.

Among the important variables (and their respective fluidity) that one must consider in trying to solve markets are: Liquidity, Economic Data, Interest Rates, Earnings, Valuations, Animal Spirits (the behavioral dynamic between fear and greed, and momentum), and of course, Politics.

Liquidity Is Still Supportive

Certain important liquidity measures that we have discussed in our letters this past year are still expanding, albeit more slowly than in 2023. Nonetheless, the liquidity cycle that bottomed in late 2022 should continue to see expansion through 2025, supporting markets and asset prices.

Recent Economic Data Point To A Slowdown

Labor and consumer data show falling economic growth rates and moderating inflation pressures. While still growing, the overall economy is slowing. However, for millions, it is not just slowing; their economic situation is deteriorating -- especially at the lower end of the socioeconomic ladder where the previous years’ inflation hit the hardest, job security is lowest, and shrinking savings have given way to growing credit card balances. All that being said, the economy is growing fast enough for well-run companies to generate real earnings growth.

Interest Rates Have Peaked, But What Does This Mean For Stocks?

Market forces have been taking interest rates down for months. Investors and traders have been closely hawking the U.S. inflation and employment data (July data get released tomorrow, August 2nd) for clues as to when the Fed will actually start cutting interest rates.

During this week’s meeting, Fed Chairman Powell made it clear that the Fed sees growing evidence that rate cuts are their likely next move… but not quite yet. While the initial reaction to Powell’s comments by investors and traders was to cheer and take stocks higher, it is fair to ask whether they should be so bullish. As we look back over the past 50 years, history shows that the period following the first Fed rate cut can be difficult for stocks. Some of the market’s worst drawdowns are during rate cutting cycles. Conversely, the period we are in right now (between the last Fed hike and the first interest rate cut) has proven to be a much better period for stocks.

What About Earnings?

Earnings expectations have gotten quite high for certain leadership stocks/industries, and this often sets investors up for disappointment. We are in the middle of earnings reporting season and so far, the stocks that we follow closely (and own for our investment management clients) have generally been reporting strong underlying fundamental trends. Innovation is rapid, and the technology stocks driving it have been doing a decent job communicating that spending on AI and other advancements continues to be robust.

A key part of our research process is going through the company press releases and listening to management conference calls. In addition to looking for new opportunities and looking for signs of accelerating earnings, it is just as important to sniff out signs of deceleration in the businesses. Our radar is always searching for signal changes.

While Earnings May Be Good, Valuations Are Still High

As we review updated earnings projections and look at where the stocks are trading, we notice that the recent pullback in the leaders has brought P/E ratios down; but many of the best stocks are still not what we would call “cheap” relative to how fast they are growing. In general, we expect we will get better opportunities to buy in the coming months.

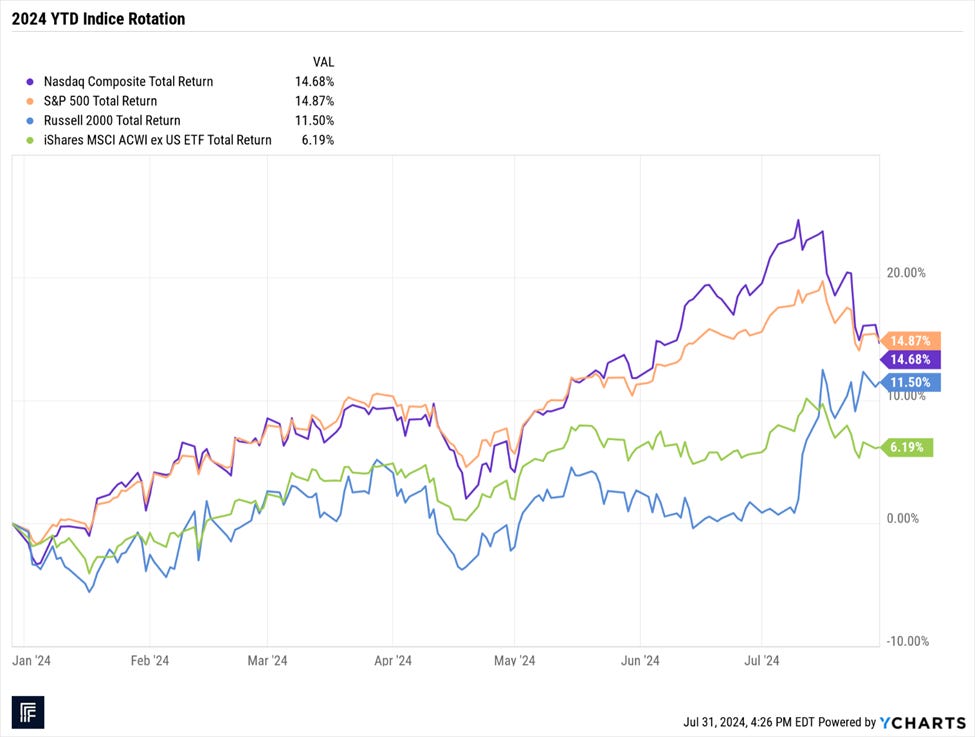

“Animal Spirits” Were Running Wild Until Early July

Momentum impulses in the markets can be capricious, and can come and go without an identifiable catalyst. For example, as July began, the “mo” train was running, but there were growing concerns about how: the indexes were becoming too concentrated in a few big names, everything had gotten way too expensive, there were too many “crowded trades,” or “everyone was on one side of the boat,” etc.

Then, in the span of a week, this disequilibrium started to correct itself. Smaller companies, cyclicals, and other areas of the market saw gains, while the momentum leaders (companies benefiting from disruptive trends like AI and GLP-1s) saw big pullbacks in share price. As this was taking place, (or as “everyone on one side of the boat” started to move around and reposition themselves, the boat got a little wobbly and stock indexes sold off. The positive to this is that when this adjustment is through, the overall stability of the boat (market) should be enhanced.

The market broadening out in July has narrowed the wide dispersion in stock index returns in 2024, and corrected what many were calling an imbalanced market.

We believe the recent rotation has been helpful in removing some of the froth in the market. A few market “pundits” refer to the market as being more “balanced” now that some of the laggards have had a nice rally. As balanced as it may be, there will still be haves and have nots, so we will look in select areas with stronger fundamentals for growth at a reasonable price (GARP) opportunities.

Politics Could Matter, A Lot

Politics may be the key variable that sets the overall tone in the next few months.

The wide swings we have seen in poll numbers these past few weeks may be with us until November. Sentiment about political developments in the U.S. this fall could meaningfully affect all other variables discussed, with the exception perhaps being global liquidity.

Economic growth expectations are certainly affected. One party seems to prefer increased government involvement in the economy, and the slower economic growth that comes with it.

Interest rates could end up being a wildcard for either political outcome. Generally, slower growth would bring lower interest rates; but if the policies are inflationary and stagflation is the result, lower rates may not persist.

Earnings expectations for each sector and industry could be greatly affected by whoever is perceived to prevail in November. Earnings forecasts could move a lot for certain groups depending on who is perceived to be winning.

Valuations (the price which an investor is willing to pay) could follow changes in earnings forecasts in an exaggerated manner, like the end of a whip. Each industry’s and sectors’ share prices will respond to the wide swings in poll numbers as traders try to get in front of perceived outcomes.

There is an opportunity for politics to unleash either upside or downside momentum. The latter brings “animal spirits” that nobody wants.

Do Stocks Have Any More Upside Given All the Complexity?

We see many reasons to remain bullish on technological innovation, the increasing efficiency it spurs, and the economic dynamism that results. Solving the investing puzzle these next few months requires analyzing and processing some complex, organic, and fluid issues.

We are optimistic, but not myopic. We will always advise investors to have an investment plan for the wide possibility of potential outcomes.

Thanks for listening; we welcome your calls and questions.

General Disclosures About This Newsletter

The publisher of this newsletter is Guild Investment Management, Inc. (GIM or Guild), an investment advisor registered with the Securities and Exchange Commission. GIM manages the accounts of high net worth individuals, trusts and estates, pension and profit sharing plans, and corporations, among other clients.

Your receipt of this newsletter does not create a personal investment advisory relationship with GIM although some recipients may also be advisory clients of GIM. GIM has written investment advisory agreements with all its personal advisory clients, which sets forth the nature of that relationship.

The newsletter makes general observations about markets and business and financial trends and may provide advice about specific companies and specific investments. It does not give personal investment advice tailored to the needs, objectives, and circumstances of individual readers. Whether investment ideas and recommendations are suitable for individual readers depends substantially on the personal and financial situation of that reader, which GIM, as the publisher of the newsletter, makes no effort to investigate.

GIM attempts to provide accurate content in its newsletters to the extent such content is factual rather than analysis and opinion, but GIM relies primarily on information compiled or reported by third parties and does not generally attempt to independently verify or investigate such information. Moreover, some content and some of the assumptions, formulas, algorithms and other data that affect the content may be inaccurate, outdated, or otherwise flawed. GIM does not guarantee or take responsibility for the accuracy of such information.

Please note that investing in stocks, other securities, and commodities is inherently risky, and you should rely on your personal financial advisors and conduct your own due diligence in connection with any investment decision.

A Special Comment for Guild’s Clients

If you are an investment advisory client of GIM who is receiving this newsletter, please note that the fact that a general recommendation is made of a particular security, commodity, or investment area to its newsletter subscribers does not mean that investment is suitable for you or should be purchased by you. For example, GIM may already have purchased such securities on your behalf or purchased securities in the same industry (and an increase in the position for you may represent too much concentration in one security or industry), or GIM may believe the investment is not suitable for you based on your risk tolerance or other factors. If you have questions about the recommendations in this newsletter in relation to your account at GIM, please contact Tony Danaher, Rudi von Abele, or Aubrey Ford.

Conflicts of Interest

As of the date of this newsletter, GIM’s investment advisory clients or GIM’s principals owned positions in areas that are the subject of current recommendations, commentary, analysis, opinions, or advice, contained in this newsletter.

GIM and its principals have certain conflicts of interest in its relations with its investment advisory clients and its newsletter subscribers resulting from GIM or its principals holding positions for its clients or themselves which are also recommended to its clients. GIM may change the positions of its clients or GIM’s principals may change their positions (increasing, decreasing, and eliminating them) based on GIM’s best judgment at any given time, including the time of publication of the newsletter. Factors that lead GIM to change or eliminate its positions may include general market developments, factors specific to the issuer, or the needs of GIM or its advisory clients. From time to time GIM’s investing goals on behalf of its investment advisory clients or the personal investing goals of GIM’s principals and their risk tolerance may be different from those discussed in the newsletter, and the investment decisions made by GIM for its advisory clients or the investment decisions of its principals may vary from (and may even be contrary to) the advice and recommendations in the newsletter.

In addition, GIM or its principals may reduce or eliminate their positions in an investment that is recommended in the newsletter prior to notifying the newsletter subscribers of such a reduction or elimination. The publication by GIM of a “target price” or “stop loss” for a particular security or other asset does not necessarily represent the price at which GIM intends to sell or will sell any such assets for its advisory clients or the price at which GIM’s principals intend to sell any such assets.

As a consequence of the conflict of interest, GIM’s clients or principals may benefit if newsletter subscribers purchase assets recommended by GIM since it could increase the value of the assets already held by GIM’s investment advisory clients or GIM’s principals. On the other hand, GIM’s principals and clients may suffer a detriment if they seek to acquire additional shares in securities that have been recommended and the price of the securities has increased as a result of purchases by newsletter subscribers.

To help mitigate these conflicts, GIM seeks to avoid recommending the securities of individual companies where GIM or its principals have an ownership position and where the issuer is small or its securities are thinly traded. That way sales by GIM in advance of possible sales by newsletter subscribers would not be likely to cause any significant decrease in the sale price to newsletter subscribers. GIM has a fiduciary relationship with its investment advisory clients and cannot agree on behalf of such clients to refrain from purchases or sales of a security mentioned in the newsletter for a period of time before or after recommendations for purchases or sales are made to its newsletter subscribers.

GIM encourages you to do independent research on the securities or other assets discussed or recommended in the newsletter prior to making any investment decisions and to be especially cautious of investments in small, thinly-traded companies, which are usually the most risky investments that you can make.

Disclaimer of Liability

GIM disclaims any liability for investment decisions based upon recommendations, information, or opinions in its newsletters. GIM is not soliciting you to execute any trade. Nothing contained in GIM’s newsletters is intended to be, nor shall it be construed as an offer to buy or sell securities or to give individual investment advice. The information in the newsletter is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject GIM to any registration requirement within such jurisdiction or country.

COPYRIGHT NOTICE

Guild’s current and past market commentaries are protected by U.S. and International copyright laws. All rights reserved. You must not copy, frame, modify, transmit, further distribute, or use the market commentaries, without the prior written consent of Guild. This email or any download from a secure website is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in error, any use, dissemination, distribution, or copying of this email is similarly prohibited. Please notify us immediately of the error by return email and please delete this message from your system. Although this email and any attachments are believed to be free of any virus or other defect that might affect any computer system into which it is received and opened it is the responsibility of the recipient to ensure that it is virus free and no responsibility is accepted by Guild Investment Management for any loss or damage arising in any way from its use.