Navigating the Future: Technology’s Role in Mitigating Economic Challenges Posed by Rising Deficits

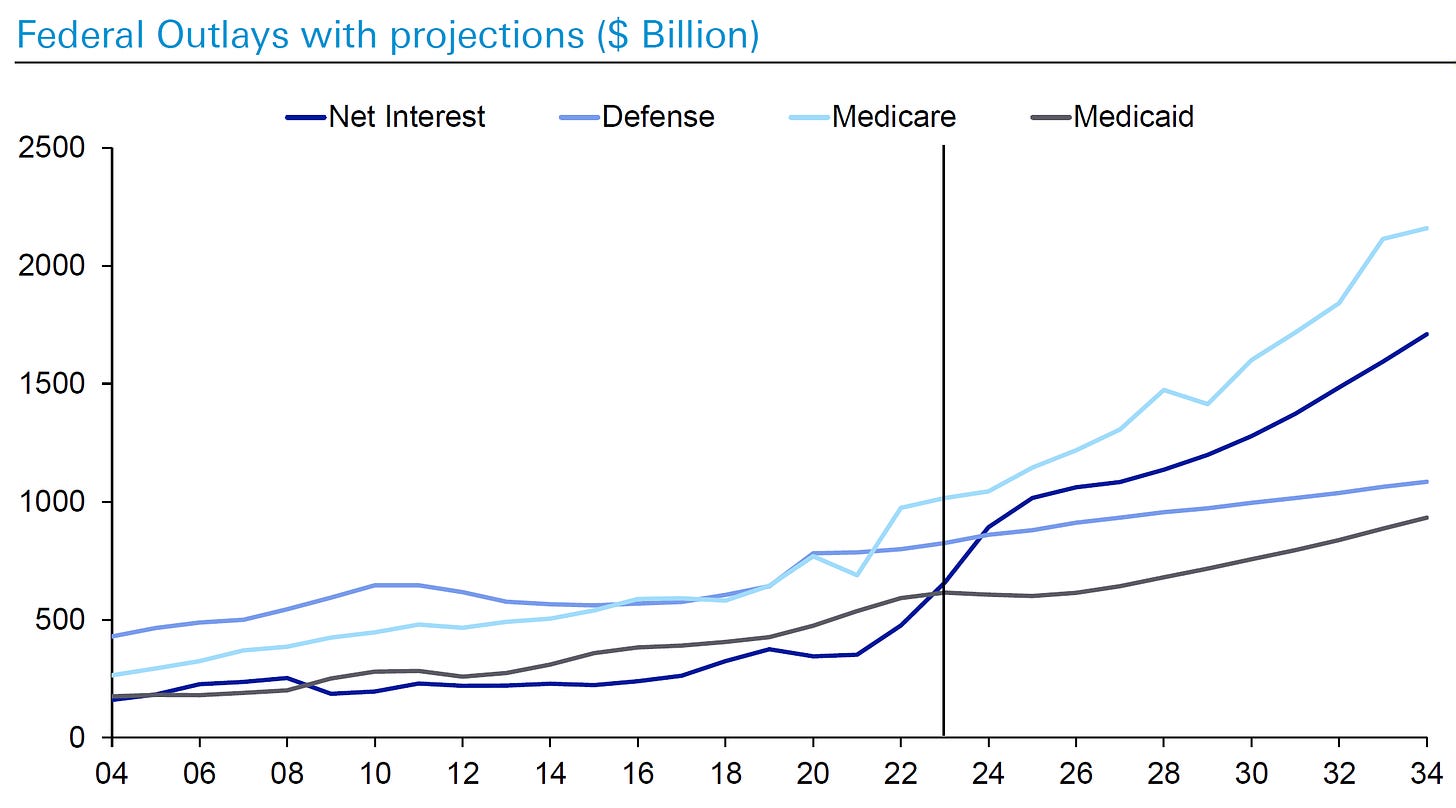

We’re optimists -- but we’re realistic optimists. There’s no denying that the United States finds itself at a critical juncture, facing a rising federal debt levels that, if unchecked, threaten to overwhelm the economy. Historical precedents from various empires and nations highlight the perilous consequences of unchecked debt accumulation. For instance, the Congressional Budget Office (CBO) forecasts that by 2034, the U.S. debt could reach 122% of GDP, surpassing levels seen during World War II, with interest payments potentially stunting income growth by 12% over the next three decades. Such alarming projections raise valid concerns about future economic stability.

Source: Deutsche Bank Research

AI to the Rescue? It’ll Help

Yet to take these troubling trends the way doomsayers take them requires one historically unjustified assumption: that the technological matrix within which the economy operates will remain static and stagnant. But the potential of technological innovation, particularly advancements in artificial intelligence (AI), has rarely been as bright. The burgeoning field of AI presents an opportunity to counterbalance the fiscal pressures exacerbated by an aging population and escalating government expenditures. This perspective holds that while deficits are indeed rising and potentially destabilizing, catastrophic outcomes are far from inevitable if technological progress, especially in AI (and some other areas we’ll mention below), is leveraged effectively.

The discourse surrounding the economic impact of AI is increasingly optimistic. Many investment strategists and economists suggest that AI could drive a productivity boom as epochally significant as major historical technological shifts such as electrification, potentially offsetting the adverse effects of high deficits. This optimism is rooted in the transformative potential of AI to enhance efficiency and spur economic growth even beyond the incremental gains previously seen with innovations like personal computers and the internet.

Of course, this kind of historical economic and market process is not new to us; we have been studying and taking advantage of these cycles of development for many decades. One of the purposes of this letter is to share the trends we’re identifying and provide an idea of what we’re doing for our investment management clients -- and not just articulate our fears, as so many other letters do.

Keep reading with a 7-day free trial

Subscribe to Guild's Global Market Commentary to keep reading this post and get 7 days of free access to the full post archives.