Oil, Inflation, Bank Crises, and Gold

We wish our readers who are celebrating the holidays a joyful Easter and Passover (and in advance, we wish Eid Mubarak to those who will celebrate it later this month).

OPEC+ (that is, OPEC plus Russia) made a surprise announcement of production cuts on Monday, bringing the cartel’s total cuts since October to a decrease of 3.66 million barrels per day. The price of crude oil immediately rose 6% in response, registering the largest one-day price spike in a year.

Foremost in our mind is the complex relationship between inflation and the price of oil. The measures of inflation most closely watched by the Fed exclude energy prices because they are so volatile. (This is one reason we think these measures are inadequate for investors’ understanding of inflation’s real impact, but that’s another discussion.) Nevertheless, even beyond the real impact of energy prices on consumers, the price of oil -- with a lag of some months -- works its way into the price of everything, because the economy as a whole is quite energy intensive (though it has become somewhat less so in the decades since the 1970s oil crisis). Packaging, logistics, and especially wages all incorporate rising energy costs. The Fed’s rule of thumb is that a $10 increase in the price of a barrel of oil increases inflation by 0.2%, and curtails GDP growth by 0.1%.

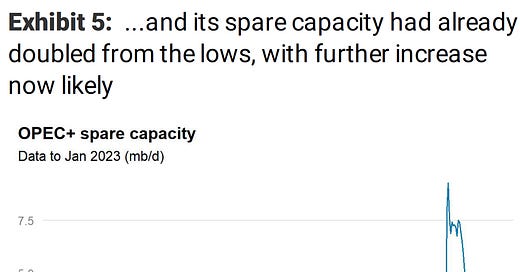

Of course, the relationship can also work the other way. Falling oil prices can reduce upward pressure on inflation, something that the Fed was perhaps relying on as it assumed its rate rises would slow economic growth and reduce oil demand at the margin, helping it in its inflation battle. Until the recent production cuts, that was the reality that seemed to be shaping up, with spare production capacity rising well off recent post-pandemic lows.

Source: Morgan Stanley Research

The actions of OPEC+ are a stick in the Fed’s craw, even if they merely keep oil in a holding pattern or support it slightly, rather than letting it decline as the economy moves into an economic slowdown, which was what the Fed was probably hoping for.

Therefore even if OPEC+ actions do not lead to a radical dislocation in oil prices -- and we don’t think they will -- they will have the effect of keeping inflation higher for longer. This is perhaps our primary takeaway from the events.

The Effects on Gold

That in turn has consequences for investors, particularly with regard to gold. Here is where Guild’s perspective, shaped by more than 50 years of participation in market conditions that have sometimes been similar to today, can be useful.

Our long experience suggests that as interest rates fall, and for a prolonged period remain below the rate of inflation, eventually, money will flow into gold. This is the situation that we see taking shape today thanks to both monetary and fiscal policy errors not wholly unlike the errors that drove gold’s appreciation in the 1970s.

In the 70s, it took people a few years to realize that inflation was going to remain elevated. At first, they believed the Fed’s over optimism about how quickly inflation would moderate, and how quickly it would be back below the prime rate. Then, after several years of failure to return to those levels, people started to increase their gold allocations.

Gold’s advance in the 1970s followed this slow shift in sentiment, even though the writing on the wall was obvious to a few observers (including us) as soon as the gold window was closed on August 16, 1971. There was a brief rally at that time, which was not enduring, in spite of the recent memory of the inflation of 1968. Then the 1973–74 recession took gold out of the mainstream again; it stayed up, but not as high as it had been. It wasn’t until 1977, 1978, and 1979 that gold really took off.

It took several years of the inflation rate (CPI -- the red line in the chart below) exceeding the Federal Reserve Fed Funds Policy Rate (the white line in the chart below) for the gold price to really start to move… as investors finally lost confidence in government’s promises to tame it.

The Fed Was Too Timid and Late To Be Effective Against 70s Inflation

Source: Bloomberg, LLP Red Line: CPI (Not Core) White Line: Fed Funds Rate

Government spread a lot of blame around -- blaming the oil embargo, the consumer, and business. The Federal government even tried implementing wage and price controls, which were an unmitigated disaster. Many people evaded them. Big companies often couldn’t evade them. Small companies succeeded in evading them, and took market share from the big. Inflation continued. Nothing worked.

Losing faith in government -- and thereby losing confidence in the value of the currency -- the public began to plunge into real estate and gold and other commodities, as a way to protect their future buying power. They felt their survival was at stake -- and they were right.

The same thing is happening now, and we are in the equivalent of about 1976 or 1977. We are not at the stage where the public is willing to plunge deeply into gold yet, but that will happen. Bitcoin has taken some luster from gold; even this is not wholly unprecedented, since in the 70s collectibles and some other commodities took some luster from gold. Real estate, of course, also did very well.

As you can see in the gold price chart below, during the inflationary cycle from January 1975 to December 1980, the metal’s price did not move in a straight line. It spent a year and a half declining from over $180/oz to about $100/oz in the summer of 1976; but the next 3½ years saw the metal go up over eightfold, ultimately peaking in January 1980 at over $870 an ounce.

Gold Futures Weekly Closing Prices 1975 to 1981

Source: Bloomberg, LLP

Not to worry if you do not have a large concentration of gold; there is also room for real estate, commodities, equities, and even bitcoin in the inflation-protection world. (We’ll get into the equity portion of inflation protection next week: not all sectors and industries will be helpful or attractive.) Investors should expect a steady, perhaps lumpy and volatile rise in the price of gold (and other assets) as inflation becomes embedded in the system and in the consciousness of investors and business owners around the world.

Let’s not forget many of the other current global trends and developments that are supportive of gold: geopolitical tensions that threaten to spill over into economic and financial blocs, resulting in realignments and displacements (Russia/Ukraine, China/Taiwan, further NATO expansion, e.g. recently to Finland); ongoing, deeply seated policy errors by monetary and fiscal authorities (as a reminder, the debt ceiling debate is going to recur this fall); and public doubts about the stability of banks (driven especially by events like the collapse of Silicon Valley Bank, Signature Bank, and Credit Suisse). While we do not want to always discuss potential catastrophic collapses and predict large economic problems in these letters, being cognizant of their possibility and probability is never absent from our analysis. Our goal is to be prepared for them, and not focus on predicting them. (With respect to the banking safety and protecting your deposits, we recommend that you revisit our letter from March 16. This is a topic we have been thinking about and writing about for over 10 years, and we are reprinting it below.)

When public officials’ inflation-fighting promises and programs become objects of scorn and ridicule, then we expect to see more substantial moves in the price of gold. Remember that just as individuals can get into “economic survival mode,” so can governments and central banks -- and they are major gold buyers.

Thus far, developments are paralleling the 70s quite closely. Be patient; it just takes time.

Thanks for listening; we welcome your calls and questions.

Banks, Brokers, and Futures: Brokers Are Happy to Take Your Money -- It’s Up to You to Know if You’ll Get it Back

Financial entities that take deposits from customers are supposed to follow certain rules and procedures, and may have insurance to convince you that your assets are protected. Regulators are also supposed to monitor the financial institution to assure that it is adhering to the regulations designed to protect depositors or clients. But often, the agreements you make with your financial institutions permit them to use your assets in ways you may not appreciate.

As we have mentioned over the past few years, at Guild we have engaged in research with our legal counsel to identify financial institutions that provide superior customer asset protection. If the assets in an investor’s account exceed government-sponsored insurance limits, we suggest that the investor choose an institution that will custody the investor’s assets and not commingle them with the assets of other clients, or with the firm’s assets.

When choosing an institution, investors should carefully read the account agreement to understand their rights and risks as a depositor. Below we provide a simplistic summary of how different types of financial entities might go about “holding” customers’ money and assets:

Typical Bank. Banks are regulated by the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC). When you deposit money into a typical bank, the bank takes your money and then is allowed to borrow more money from the Federal Reserve or other parties to make loans or to invest on behalf of the bank. A bank might keep only 10–12 % of your deposits on hand as a reserve. If the bank makes bad investments and becomes insolvent, the FDIC will step in to take over and provide up to $250,000 in insurance for the funds that the bank’s depositors may have in different categories of legal ownership. The FDIC refers to these different categories as “ownership categories.” This means that a bank customer who has multiple accounts may qualify for up to $250,000 in insurance coverage for each account if the customer’s funds are deposited in different ownership categories and the requirements for each ownership category are met. Check with your bank to make sure each of your different accounts is covered up to $250,000.

Note that the FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities, or municipal securities, even if these investments are purchased at an insured bank. The FDIC also does not insure safe deposit boxes or their contents.

Sound bank management and the FDIC are your primary protections as the bank statement you receive at the end of the month represents an IOU of sorts. As mentioned above, we prefer having a custody account with a bank in those cases where the amounts exceed insurance coverage. Custody may cost more, but the protections afforded are a service worth paying for in our opinion.

Securities Brokers. Securities brokers are regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). If a brokerage firm fails and owes its customers money and/or assets, the Securities Investor Protection Corporation (SIPC) will pay out of its reserves up to $500,000 in cash and securities (up to a maximum of $250,000 in cash) to the depositors to cover securities or other assets that are missing from the firm. SIPC’s protection is different from the protection offered by the FDIC. When a member bank fails, the FDIC insures all depositors at that institution against loss up to a certain dollar limit because most savers (bank depositors) put money in a bank account that they can’t risk losing.

That is different from investors with securities accounts who are presumed to understand that there are risks involved in investing in securities. As a result, unlike the FDIC, SIPC does not cover investors when the value of their stocks, bonds and other investments falls for any reason. Instead, when a broker fails, SIPC comes in and searches for your assets and replaces missing stocks and other securities. If your investment in a security declines in value before it is replaced by SIPC, the insurance still has satisfied its obligation by delivering to you the missing security even if it is now worth substantially less.

SIPC does not cover individuals who are sold worthless stocks and other securities. SIPC helps individuals whose money, stocks and other securities are stolen by a broker or put at risk when a brokerage fails for other reasons.

Also, it is important to understand that when you have securities in a brokerage firm account, the broker may have great latitude to use your assets as they see fit. If you have a margin account, for example, the account agreement will often permit the broker to borrow all the securities in your account (which it can then lend to others for short selling and make a fee), whether or not you are actually trading on margin. If the broker fails after borrowing your securities, those assets may not be covered by SIPC because they may not be deemed “missing” from your account. Instead, by agreement you surrendered the securities to your broker and became merely a general creditor of the broker for the value of the securities. You need to be very careful about what authority you gave the broker to borrow your securities.

The statement the broker sends you at the end of the month can be viewed as an IOU. The brokerage industry is competitive and brokers will tell you that they also have excess-SIPC insurance policies that will protect their customers for up to $100 million dollars or some other large number. First, whatever the number is, it is not an amount of insurance applicable to your account only; it is a maximum amount of coverage applicable to all accounts at the firm and is probably not enough to cover all accounts if the broker fails. Second, the insurance may have the same limitations as SIPC and only cover “missing” securities or other assets.

It is our view that you need to carefully review your brokerage account agreement, and if you want to trade on margin, do so only in an account where you don’t care that the broker will borrow all your securities in that account. Keep the remainder of your assets in an account where the broker is prohibited by your account agreement from borrowing the securities. In addition, if you have more than $500,000 in cash and securities at a broker, our view is that you should pick the most conservative firm with the best procedures and the best audits of its segregation of customer assets, rather than rely on the broker’s statement about how much additional insurance it has. If a broker fails, the third party insurance policy is not likely to be sufficient.

Futures Brokers or Futures Commission Merchants. Futures brokers are regulated by the National Futures Association and the Commodity Futures Trading Commission. Futures brokers take money from customers and allow the customer to trade, speculate, and hedge in the leveraged futures markets. The customers have to keep a minimum margin in their account to cover the positions they have. The broker is supposed to keep the excess equity or cash that belongs to the customers in segregated customer fund accounts. If the broker goes bust, there is no government-mandated or sponsored insurance. The primary asset protection provisions futures traders can rely on are the internal procedures, the quality of the regulatory oversight, and the honesty of the people in the firm. As we have said in recent letters, our advice to commodity account holders is that they only keep the minimum needed in their accounts to cover the required margin since the statement you get from the merchant is little more than an IOU.

General Disclosures About This Newsletter

The publisher of this newsletter is Guild Investment Management, Inc. (GIM or Guild), an investment advisor registered with the Securities and Exchange Commission. GIM manages the accounts of high net worth individuals, trusts and estates, pension and profit sharing plans, and corporations, among other clients.

Your receipt of this newsletter does not create a personal investment advisory relationship with GIM although some recipients may also be advisory clients of GIM. GIM has written investment advisory agreements with all its personal advisory clients, which sets forth the nature of that relationship.

The newsletter makes general observations about markets and business and financial trends and may provide advice about specific companies and specific investments. It does not give personal investment advice tailored to the needs, objectives, and circumstances of individual readers. Whether investment ideas and recommendations are suitable for individual readers depends substantially on the personal and financial situation of that reader, which GIM, as the publisher of the newsletter, makes no effort to investigate.

GIM attempts to provide accurate content in its newsletters to the extent such content is factual rather than analysis and opinion, but GIM relies primarily on information compiled or reported by third parties and does not generally attempt to independently verify or investigate such information. Moreover, some content and some of the assumptions, formulas, algorithms and other data that affect the content may be inaccurate, outdated, or otherwise flawed. GIM does not guarantee or take responsibility for the accuracy of such information.

Please note that investing in stocks, other securities, and commodities is inherently risky, and you should rely on your personal financial advisors and conduct your own due diligence in connection with any investment decision.

A Special Comment for Guild’s Clients

If you are an investment advisory client of GIM who is receiving this newsletter, please note that the fact that a general recommendation is made of a particular security, commodity, or investment area to its newsletter subscribers does not mean that investment is suitable for you or should be purchased by you. For example, GIM may already have purchased such securities on your behalf or purchased securities in the same industry (and an increase in the position for you may represent too much concentration in one security or industry), or GIM may believe the investment is not suitable for you based on your risk tolerance or other factors. If you have questions about the recommendations in this newsletter in relation to your account at GIM, please contact Tony Danaher, Rudi von Abele, or Aubrey Ford.

Conflicts of Interest

As of the date of this newsletter, GIM's investment advisory clients or GIM's principals owned positions in areas that are the subject of current recommendations, commentary, analysis, opinions, or advice, contained in this newsletter.

GIM and its principals have certain conflicts of interest in its relations with its investment advisory clients and its newsletter subscribers resulting from GIM or its principals holding positions for its clients or themselves which are also recommended to its clients. GIM may change the positions of its clients or GIM's principals may change their positions (increasing, decreasing, and eliminating them) based on GIM's best judgment at any given time, including the time of publication of the newsletter. Factors that lead GIM to change or eliminate its positions may include general market developments, factors specific to the issuer, or the needs of GIM or its advisory clients. From time to time GIM's investing goals on behalf of its investment advisory clients or the personal investing goals of GIM's principals and their risk tolerance may be different from those discussed in the newsletter, and the investment decisions made by GIM for its advisory clients or the investment decisions of its principals may vary from (and may even be contrary to) the advice and recommendations in the newsletter.

In addition, GIM or its principals may reduce or eliminate their positions in an investment that is recommended in the newsletter prior to notifying the newsletter subscribers of such a reduction or elimination. The publication by GIM of a "target price" or "stop loss" for a particular security or other asset does not necessarily represent the price at which GIM intends to sell or will sell any such assets for its advisory clients or the price at which GIM's principals intend to sell any such assets.

As a consequence of the conflict of interest, GIM's clients or principals may benefit if newsletter subscribers purchase assets recommended by GIM since it could increase the value of the assets already held by GIM's investment advisory clients or GIM's principals. On the other hand, GIM's principals and clients may suffer a detriment if they seek to acquire additional shares in securities that have been recommended and the price of the securities has increased as a result of purchases by newsletter subscribers.

To help mitigate these conflicts, GIM seeks to avoid recommending the securities of individual companies where GIM or its principals have an ownership position and where the issuer is small or its securities are thinly traded. That way sales by GIM in advance of possible sales by newsletter subscribers would not be likely to cause any significant decrease in the sale price to newsletter subscribers. GIM has a fiduciary relationship with its investment advisory clients and cannot agree on behalf of such clients to refrain from purchases or sales of a security mentioned in the newsletter for a period of time before or after recommendations for purchases or sales are made to its newsletter subscribers.

GIM encourages you to do independent research on the securities or other assets discussed or recommended in the newsletter prior to making any investment decisions and to be especially cautious of investments in small, thinly-traded companies, which are usually the most risky investments that you can make.

Disclaimer of Liability

GIM disclaims any liability for investment decisions based upon recommendations, information, or opinions in its newsletters. GIM is not soliciting you to execute any trade. Nothing contained in GIM's newsletters is intended to be, nor shall it be construed as an offer to buy or sell securities or to give individual investment advice. The information in the newsletter is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject GIM to any registration requirement within such jurisdiction or country.

COPYRIGHT NOTICE

Guild’s current and past market commentaries are protected by U.S. and International copyright laws. All rights reserved. You must not copy, frame, modify, transmit, further distribute, or use the market commentaries, without the prior written consent of Guild. This email or any download from a secure website is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in error, any use, dissemination, distribution, or copying of this email is similarly prohibited. Please notify us immediately of the error by return email and please delete this message from your system. Although this email and any attachments are believed to be free of any virus or other defect that might affect any computer system into which it is received and opened it is the responsibility of the recipient to ensure that it is virus free and no responsibility is accepted by Guild Investment Management for any loss or damage arising in any way from its use.